Get the answers

Through the home page (Banner or All Products section)

- Confirm you meet the criteria

- Check financial commitments

- Input Salary Details

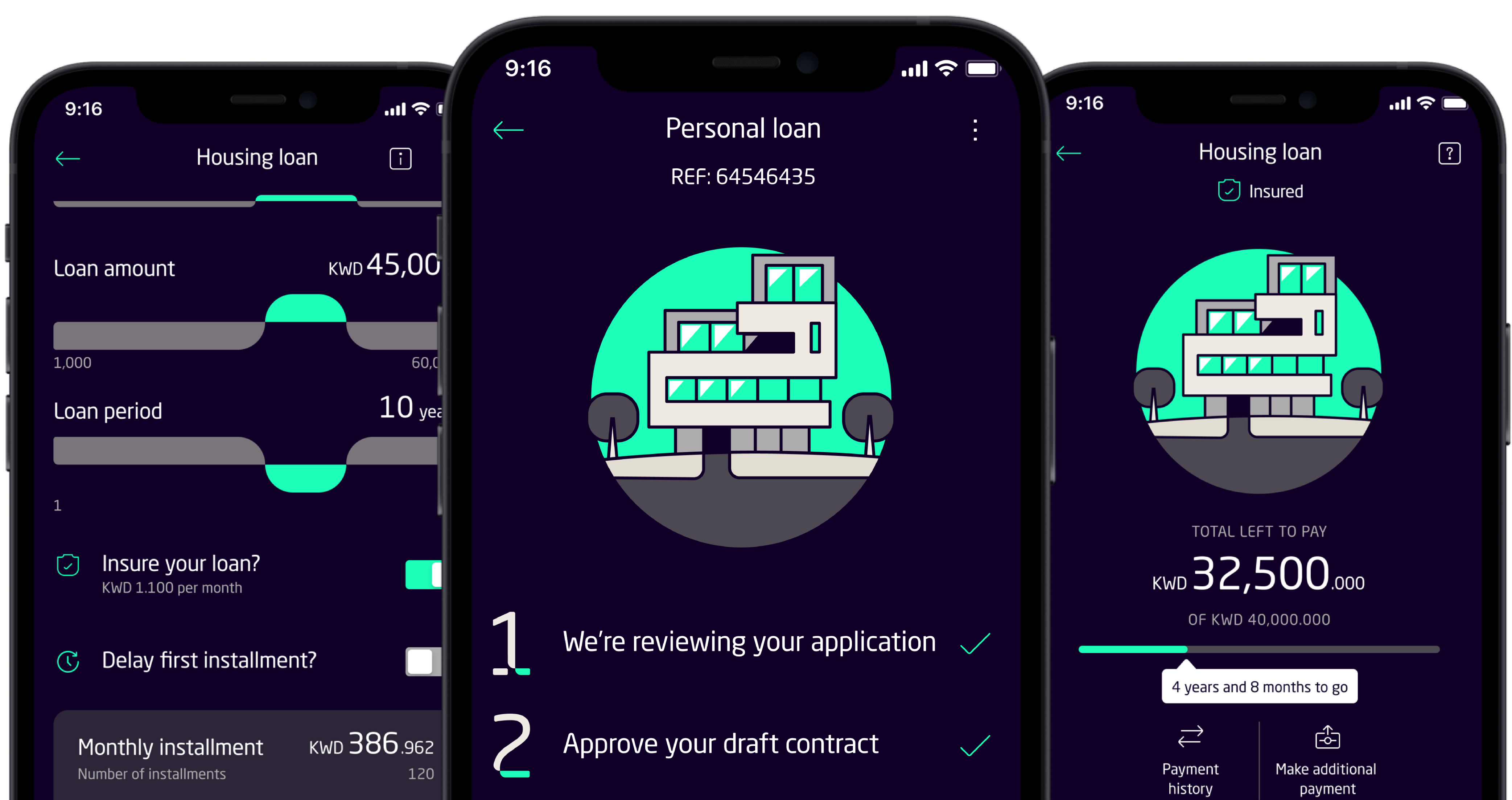

- Select loan option and type, amount, insurance, and all other details.

- Upload documents

- Confirm and Submit loan

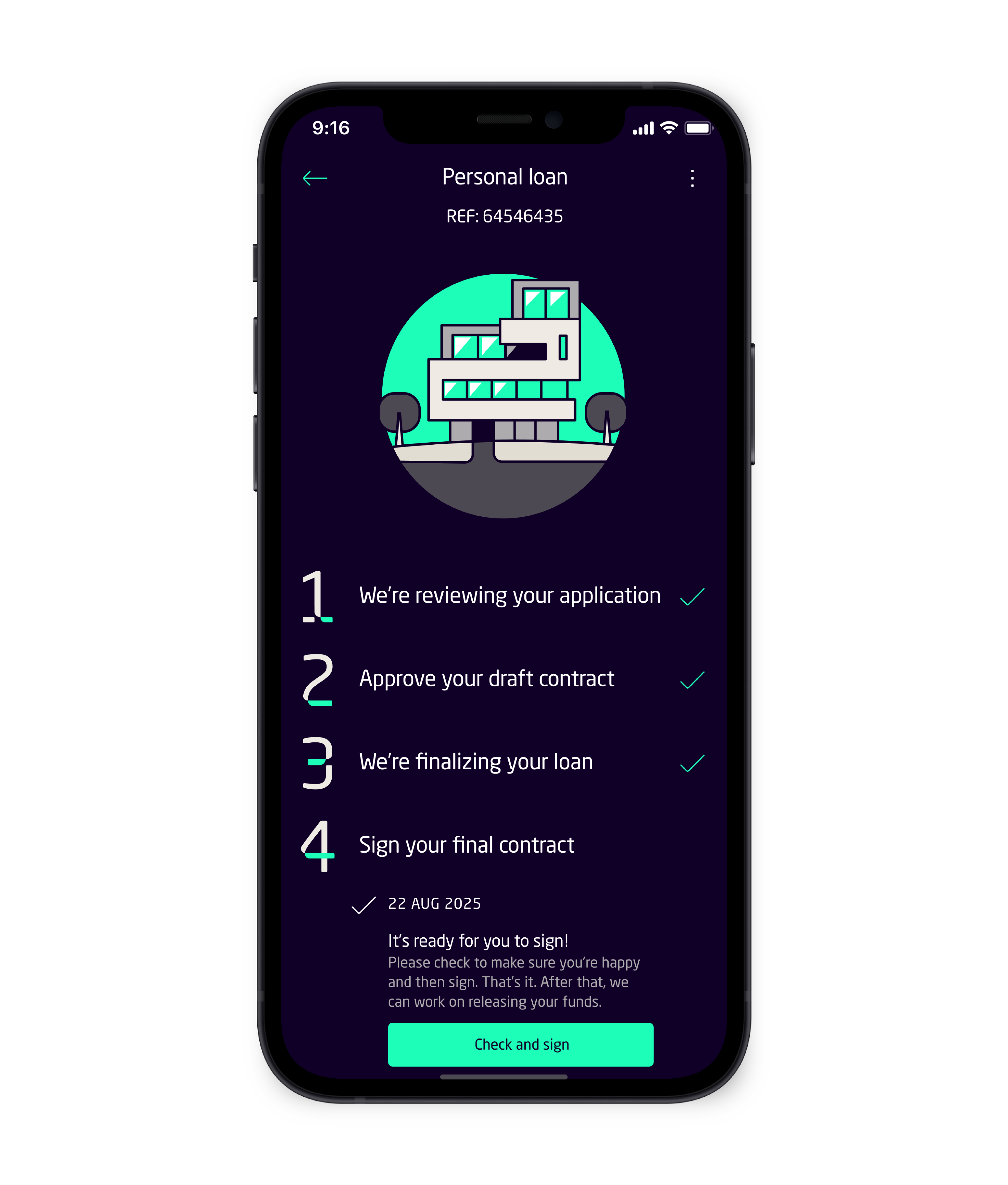

• After signing the draft contract, you’ll be able to sign the final contract within 48 hours.

• After signing the final contract, the funds will be deposited within 24-48 hours

• Yes, your salary needs to be with Weyay, but if your employment support is not transferred, it will affect the loan amount you can apply for.

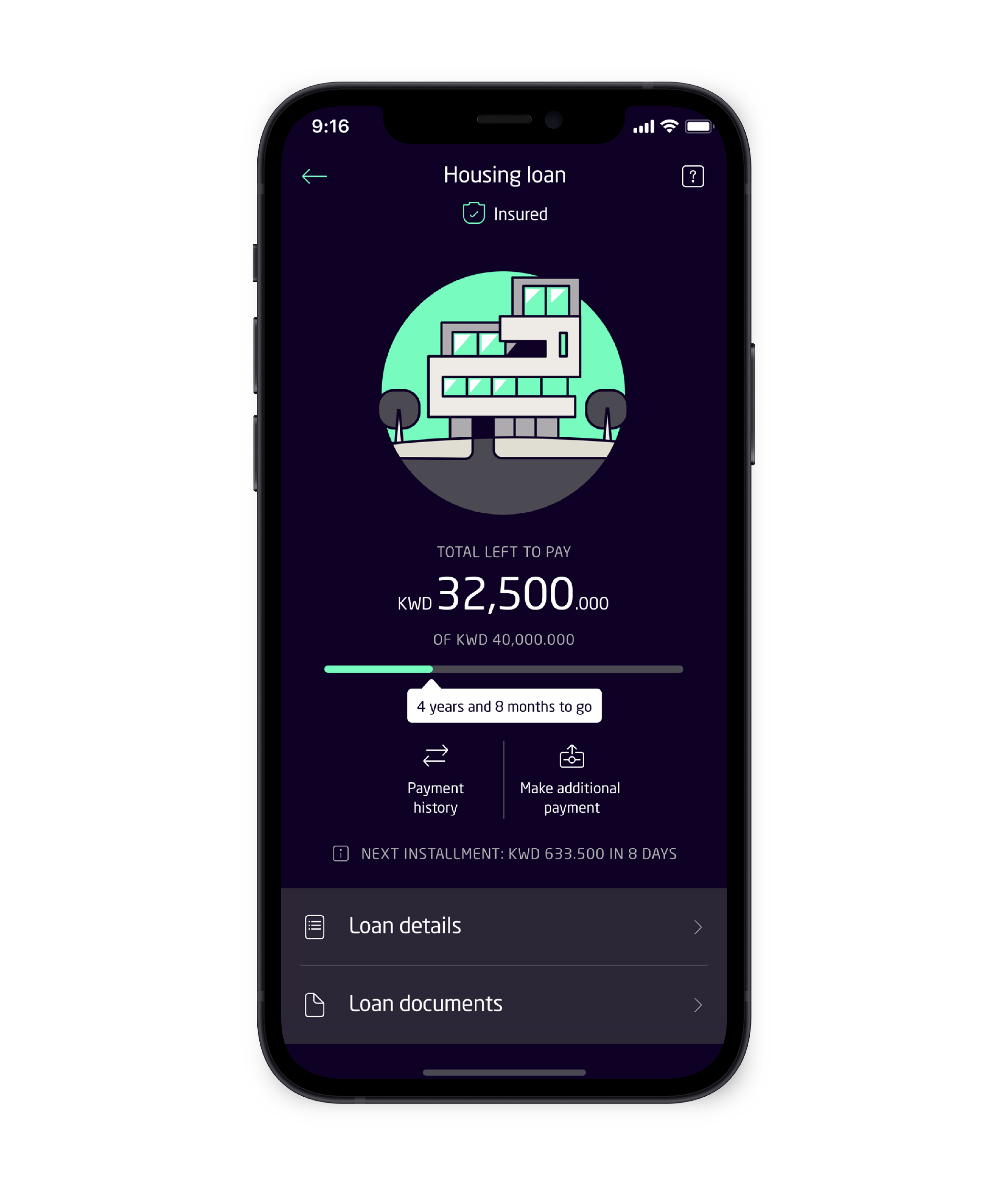

• The loan won’t be affected unless a new amortization schedule has been provided, and the interest is updated. The interest rate can be updated once every 5 years throughout the loan lifecycle

• Kuwaiti Citizen.

• 21+ Age Requirement.

• Loan applicants must be under 70 years old, and loan must mature before age of 70.

• Financial liabilities should not exceed 40% of the net salary.

• Digital Signature is the third level of authentication Kuwait Mobile ID (KMID) app. It allows you to sign legal papers digitally.

• Before signing the final loan contract, you need to have the third level of authentication Kuwait Mobile ID (KMID) if you don't have it then you must visit a KMID kiosk and manually verify.

• 450 KD minimum salary

• Weyay Bank offers two types of loans:

–Personal Loan (1,000 - 25,000 KWD)

–Housing Loan (1,000 - 70,000 KWD)

%20-%20EN%20-%20R.png)